Many do not think of Duck Key as an old Key. It was bypassed by the railroad in 1912 and the Overseas Highway after when rebuilt after the 1935 Hurricane. As it is today at MM 61, it is a new Key. Bryan Newkirk purchased the island in 1956 and with a consortium of partners pumped several million dollars along with many million cubic yards of fill.

- Name -

-Like most of the Keys, Duck Key was unnamed on early Spanish charts. It was included as one of the "Key Vaccas", or Cow Keys. It is not specifically named on the 1733 Spanish treasure recovery maps. A 1772 chart by DeBrahm labels it as Reynolds; however, William Gerard de Brahm, a Swiss, gave many the Keys his own names. He was the first Surveyor General for British East Florida.

Again it took George Gauld to name it Duck Key in his chart of 1775. Gauld names the west end of "Duck Key" as a fresh water source in his "Of the Watering Places on the Florida Keys." Gauld did a credible job of surveying the Keys; however , was interrupted by the Revolutionary War of 1776.

When Florida became an American possession in 1821 and its Board of Florida Land Commissioners accepted Ferreira's claim which was later approved by an Act of Congress, May 26, 1830. Others in the U. S. and Florida governments treated the five islands as public domain and transferred ownership for various programs. The positive legal ownership debate goes on and on, but was evidently resolved in 1899.

Duck Key was excluded from some of the legal discussions as Ferreira had sold Key Vaca to Isaac Cox for $3,000 on September 4, 1824, (Deed book E, St. Johns County, Florida) which was $1,000 more than the selling price of Key West. Three years later, Cox sold Key Vaca (all five islands) to Charles Howe of Indian Key fame for $1,500. However, another case of the Spanish owners selling land twice as they did Key West, Ferreira also sold Duck Key to Sol Snyder on June 11, 1823.

Today, the American society is trying to reduce salt intake; however, if necessary many acclaimed chefs still suggest the natural element of sea salt or "fleur de sel." Before refrigeration, salt was absolutely necessary for prolonged food preservation, processing and shipment.

It is believed that salt production was the goal for Charles Howe's acquiring Duck Key in 1827. The Key West Register on April 9, 1829 printed: "Election Notice - In pursuance of law . . . the following named persons to be the judges of the election, which will be held the first Monday in May, next for a - Delegate to Congress on Indian Key, the store of Thomas Gibson - judges: Charles Howe, Joseph Prince and Thomas Gibson. . . ."

It is about 30 miles from Indian Key to Duck Key and Indian Key had the only store next to Key West; therefore, was it possible for him to be living on Duck Key? The 1830 census, which did not list specific locations and only the name of the head of the household, listed Charles Howe as a household of 13 members, five of which were slaves. Therefore, the slaves could have been operating the salt ponds.

Early salt production was labor intensive. Generally the lower technology consisted of gates to allow seawater to enter evaporation vats at high tide, close the gates, allow evaporation, allow more seawater, etc. until a brine was obtained, siphon off the brine into a separate pickle vat, then to a crystallizing vat, where the salt was raked off, dried and bagged. As this required considerable construction, the author believes that even a simpler method was used at Duck Key.

Charles Howe was appointed and confirmed a Monroe County Justice of the Peace on January 18, 1831.

John Lee Williams in his 1837 Territory of Florida wrote: "Duck Key is a narrow rocky islet, containing some fine salt ponds. Mr. Howe, from Charleston, made a considerable establishment on the island for the purpose of making salt, but having died since, the project has been abandoned. It is about two miles long."

Was Williams wrong about Howe's death are was there another Charles Howe?

The Charles Howe of Indian Key was born August 12,1801 in Massachusetts and married his first wife, Ann Cole on April 20, 1825, had three children, Sarah, Edward and Charles Jr., and he died January 27, 1873 in Hadley, Mass. His son Charles Jr. married in 1852 a Mary Ann Johnson of Duck Key.

The land deed of Isaac N. Cox to Charles Howe of Key Vacas, ". . . Charles Howe, of the city of Charleston, the state of South Carolina." However, Horatio Crain, Howe's son-in-law, in 1885 stated to the land commission that "my father-in-law, Charles Howe, who had the salt works there and who subsequently sold to Willaim C. Dennis whose heirs hold the title."

Of interest are excerpts from the Charleston Daily Courierdated January 10, 1858 of a voyage made to Knight's Key with Charles Howe: ". . .Commenced with Knight's Key, containing about one hundred and twenty-five acres of arable [plowable] land, and has a comfortable house and cistern. On this Key we have twelve hundred cocoanut trees and about fifty thousand Sisal hemp plants, most of which are fit to cut and manufacture into hemp...." They sailed on "...Passed Duck Key, where much money was expended on forming a salt pond...."

Regardless, there were salt ponds on Duck Key and later Charles Howe obtained controlling interest in the salt works in Key West in 1843, then sole ownership after the hurricane of 1846.

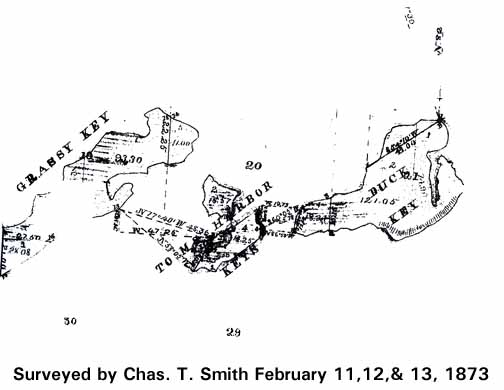

The state survey the Keys in the 1870s and the Duck Key portion of map is shown to the right.

Duck Key is about the same size as the kingdom of Monaco and set for a major change.

- Modern Day Duck Key -

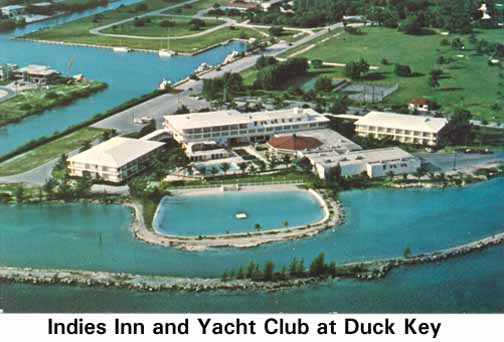

Duck Key took a herculean leap forward in 1951. Bryan W. Newkirk, an internationally know financier and mining executive purchased the island for about $4,000,000 to make it a 400 acre island community. Newkirk had made Coral Gables, Florida his winter home since 1924 and had definite ideas for the island's amenities. An airport was available 12 miles away at Marathon; however, a golf course and yacht club would be needed and an improved 16,000 foot entrance causeway.

By 1952 a wooden bridge connected Duck Key to highway U.S. 1 and construction really took off with Alonzo Cothron of Islamorada as the principal contractor. The interconnecting canals were the source of landfill.

On January 2, 1953, the million dollar causeway from US 1 to Duck Key was officially opened for vehicle traffic. State Representative Bernie C. Papy was the master of ceremony.

-

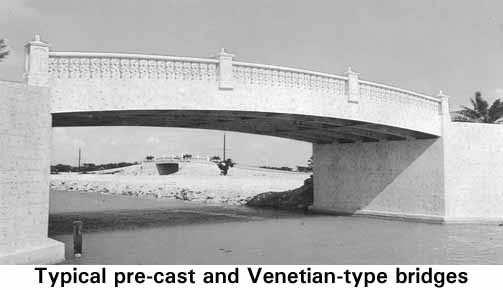

Newkirk was smarter than other developers and made all his canals through waterways so they could flush with the tidal changes. Actually, he made five islands, Indies, Centre, Harbour, Plantation and Yacht Club islands. There are about 10 miles of paved roads and four decorative stone bridges not including the entrance causeway.

-

-

-

-

Ownership changed in 1983 when the Pompano Beach Barrington Group purchased the holdings and made extensive changes. The resort was the Hawk's Cay Resort and Marina. Additional swimming pools and recreational facilities were added in the late 1990s.

-

The Singh Company of Key West, well known for the Truman Annex, entered the Upper Keys in the middle 1990s and began Hawk's Cay Village. This added several hundred Caribbean style cottages all with water views, porches and the traditional white picket fence.

-

All in all there must be approaching 400 homes, multiple recreational facilities and complete convention facilities. Duck Key is now (2004) struggling with Keys wide wastewater disposal problems. Hawk's Cay Resort has a treatment plant, but the individual homes are on septic tanks.